What is p2p lending as an investment?

P2P lending is rising in popularity among investors, and lending platforms are something that more and more people hear about.

So, here is what you need to know if you’re considering becoming a P2P lender or are simply interested in how this relatively new lending sector operates.

What is Peer-to-Peer (P2P) Lending?

P2P lending eliminates the need for a bank or other financial institution and lets private investors lend money to people and companies. P2P lending has gained popularity as an alternative lending method because of its benefits to borrowers and investors. A P2P lending platform is what connects them.

History of (P2P) Lending

Early on, the P2P lending system was viewed as a method to consolidate student loan debt at a lower interest rate.

However, P2P lending platforms have widened their audience in recent years. The majority of them now concentrate on customers who wish to pay off credit card debt with a lower interest rate. P2P lending websites also provide vehicle loans and loans for home improvements.

Also, P2P lending platforms have become a popular place for investors since they can invest money into the pool that can go towards satisfying borrowers’ financial needs.

How does P2P Lending work?

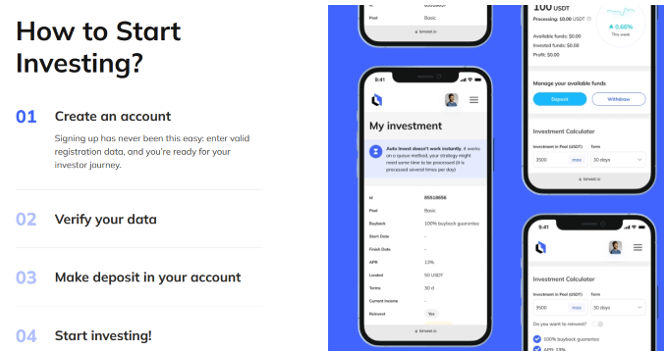

An investor who participates in peer-to-peer lending deposits their money into the pool to loan. The investor will get interest on the loan installments in exchange. They both will need to create accounts on a P2P lending platform like Lonvest.

These online marketplaces pair prospective loan borrowers while paying investors back with interest dividends. The borrower will fill out some basic information when applying for a loan, just like a conventional loan.

Personal loans make up the majority of the financial goods available, albeit the lender may have its requirements. For instance, some lenders provide loans designed especially for consolidating debt.

Following completion of the application, the platform will review the applicant’s credit report and put them in the list for further matching. The lender will fund the loan after matching with the applicant.

Is Peer-to-Peer Lending (P2P) Legal?

P2P lending isn’t an old option like regular bank lending. Therefore, there hasn’t been a similar history of governmental inspection and regulation in the P2P lending sector.

But just like any other lender, P2P lending platforms must abide by the rules of the country they’re registered in. Which means – they’re legal in most cases.

Advantages and disadvantages of P2P investment platforms

Advantages of P2P investment platforms

P2P loans might have more lenient qualifying standards than conventional bank loans. However, P2P lending platforms cooperate with trusted lending companies that do all the necessary checks for them.

Also, they’re pretty secure as they guarantee a stable payment schedule and reasonable risk balance. Stablecoin investments with APRs higher than on exchange platforms are a good example.

Disadvantages of P2P investment platforms

P2P loans might include greater costs than typical loans or extra fees. Usually, it’s tied to the platform’s administration costs, but most platforms charge only transaction fees.

Types of P2P Lending

P2P Lending for Personal Loans

Exactly what it says on the title – this type means that loans are given to individuals for their personal financial needs. This is the most common and accessible type of P2P lending.

P2P Lending for Crypto Users

Now, P2P loans can also be issued in cryptocurrencies – the most convenient option for investors worldwide. Mostly, platforms like Lonvest use stable coins because they’re less volatile than other cryptocurrencies.

Peer-to-Peer (P2P) lending and tax

P2P lending revenue is typically considered to be income, making it taxable. Since these investments aren’t regulated in most countries, they fall under the savings category, which is taxed starting from quite big amounts.

Beyond your savings allowance, interest is paid at your highest marginal tax rate.