Can You Open a Bank Account in Switzerland Nowadays? Yes, You Can!

Swiss banks have been providing banking services to customers from all parts of the globe for centuries. Today, 25% of the total world capital kept in foreign banks is kept in Switzerland. No other country is such a huge deposit holder. However, there is a chance that you’ve heard rumors that it has become impossible to open an account in a Swiss bank. This is not so. Due to the international anti-money laundering and counter-terrorism financing efforts, it has become more challenging to set up a bank account in Switzerland but this is certainly not impossible.

The banking sector plays a pivotal role in the Swiss economy. It generates a large portion of the overall national income and the Swiss are naturally doing their best to stay afloat in the changing environment. They couldn’t possibly have stopped opening bank accounts for foreign citizens because this would have caused financial losses of an enormous size. The Swiss banks need international clients and they will continue to set up accounts for them without any doubt. We must note, however, that the demand for their services is so great that they can afford to be rather choosy when it comes to taking a foreign client aboard. It is also true that the due diligence procedures implemented in Switzerland are probably tougher than they are in any other country of the world but this is understandable. Swiss banks want to preserve their spotless reputation, which will allow them to remain the leaders in the banking industry. So, setting up an account in a Swiss bank is not an easy endeavor these days but it does not mean that you cannot bank in Switzerland. You can.

You may also have heard that you have to make a deposit of at least one million francs, dollars or euros to be able to obtain services from a Swiss bank. This is partially true. However, this does not apply to all banks in the country (that are 246 in number, by the way). Yes, large banks in Switzerland are likely to deny service to a customer who wants to make a smaller deposit but there are mid-size and small banks in the country that are prepared to work with customers who are not super-rich. So, even if you do not have a million to put in a Swiss bank, setting up an account in the country is still possible. What you have to do is find a financial institution that will agree to take you onboard. Offshore-Pro Group has been cooperating with a large number of Swiss banks and the company experts know precisely which banks in the country are more cooperative and what it takes to open an account with this or that bank.

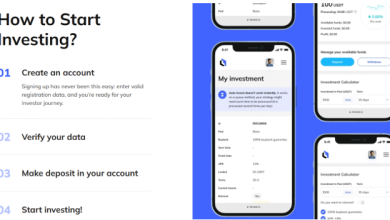

What particular Swiss bank you should choose will largely depend not only on the amount of capital that you’d like to deposit but also on your banking preferences. Below we will point out a few banks in Switzerland that do open accounts for international clients. Each of the banks that we are going to refer to will suit some purposes better than others. You must realize, however, that if you bank in Switzerland, the highest quality of banking services is guaranteed in a vast majority of cases. One of the reasons why the country remains the top service provider in the banking industry is the Swiss bankers’ ability to quickly adapt to all the recent changes and follow the latest trends in their areas of specialization. In particular, they are making full use of the technological advancements that have become available over the last few years. Fintech, blockchain, online banking – all of these are widely applied by Swiss banks.

Now let us briefly talk about the Swiss banks that you may find most attractive if you are a citizen of a foreign country who wants to set up a bank account in Switzerland. In case you put a high value on a big brand name, you should probably apply for services to a large Swiss bank such as UBS or Pictet, for instance. We must note, however, that UBS in particular is extremely good at servicing ultra-rich clients. When it comes to providing services to ordinary clients, however, the service quality that such clients can count on is average. Thus, if you would like to set up an account with a huge Swiss bank (or should we say ‘with an international bank headquartered in Switzerland’), you’d be better off opting for Pictet.

If you would like to obtain services from a private bank in Switzerland, we recommend that you give an eye to Reichmuth. The bank is comparatively young (it was established in 1988) but the phrase ‘private bank’ has a special meaning in Switzerland. It means that the bank is not registered as a limited liability company. Instead, its owners have unlimited liabilities for all the assets that the bank has and all the commitments that it makes. What are the consequences of such a state of affairs? The bank owners are going to be exceptionally careful in managing your capital. Making a deposit in this sort of bank should make you 99.99% sure that your money is perfectly safe.

If you want your Swiss bank to have branches and representative offices in many other countries, you should consider J. Safra Sarasin bank. If you take in account Safra National Bank of New York, which is a separate legal entity but essentially a division of the bank, you will find that it has branches in a great number of European, Middle East, North American, and South American countries.

As we have noted at the beginning of the article, not all Swiss banks require a million dollars or euros as the initial deposit. If you’d like to make a modest deposit, you can consider Sim Bank in Switzerland. They will open an account for you if you bring as little as 5,000 Swiss francs. Dukascopy – an e-bank that is totally online – will accept US$ 100 as the initial deposit. Thus, banking in Switzerland is still possible and it can be highly rewarding.