Pay Stub for Self Employed

Did you know that there are 15 million self-employed workers in the US?

As a solopreneur, you may have more freedom and flexibility than a regular employee. But that freedom also comes with a higher level of responsibility, especially with your finances.

Unlike receiving a W-2 form at the beginning of each year, anything from tax season to getting a loan can be complicated if you don’t plan your financial documents accordingly.

This is why creating a pay stub for self-employed workers can be a smart move. This short guide will teach you everything you need to know about creating your next pay stub!

Pay Stubs: What Are They And Why Do You Need Them?

A pay stub is a document that comes with an employee’s paycheck.

Since you’re self-employed, you’re responsible for creating your own pay stub based on your personal earrings.

Even though federal law doesn’t require you to have pay stubs, creating one as a freelancer or solopreneur can help you in situations like:

- Getting a personal or business loan

- Buying or renting property

- Establishing a line of credit

- Compensation after an accident

- Keeping accurate financial records

- Filing your taxes

- Showing official proof of income

Even if you keep financial records, creating a professional pay stub will make your life much easier during these instances.

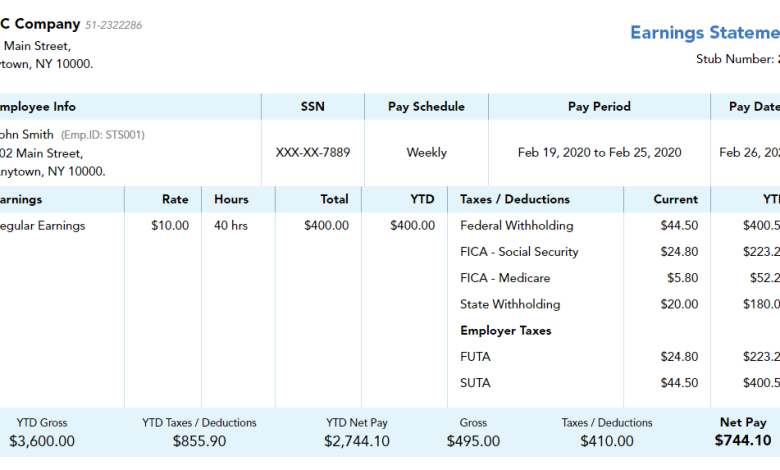

What Information Is On a Pay Stub?

Before creating your pay stub, you need to know what kind of information you need to make one.

Normally, pay stubs include:

- Your name and address

- Company or client’s information

- Social security number

- Gross income

- Net earnings

- Pay schedule

- Tax deductions (social security, medicare, etc.)

- Hours worked per pay period

- Tax withholdings

- Total year-to-date earnings

Once you have this information, there are a few ways you can create your official pay stub.

Some states require specific details, so always check beforehand to see if you need anything extra.

How To Create A Pay Stub For Self-Employed Workers

Creating our own pay stub has never been easier. There are a couple ways you can create one that fits your needs.

Create a Pay Stub Using a Template

Many legal and state websites offer free pay stub templates you can download. Some of these paystub template allow you to personalize them based on your situation.

If you want to save money and you’re comfortable manually filling everything out yourself, this can be a great option for you.

Use a Pay Stub Generator

A template can save you money, but a reliable pay stub generator can save you time.

All you need to do is fill out your information, pay a small fee, and that’s it! The generator will automatically calculate your earnings for you and make a professional pay stub.

Time To Make That Pay Stub

Having a pay stub for self-employed workers is essential in many situations.

From getting a loan to renting an apartment, that simple document can make a huge difference in your professional and personal life. Start using the instant pay stub generator!